ABOUT MMA

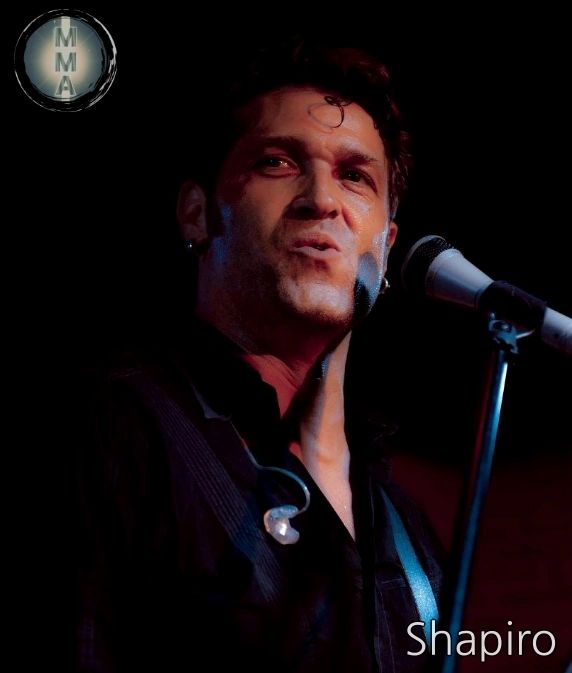

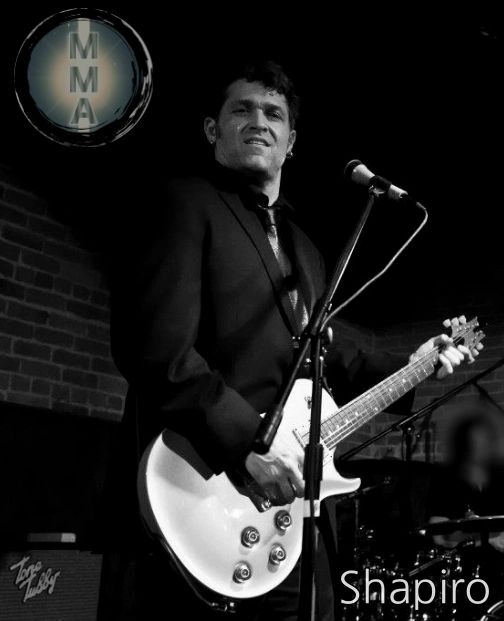

THE MUSICIANS & SONGWRITERS

Guitarist Miles Schon and Vocalist Michael Shapiro, alongside Producer Tom Fletcher, have created a brand new original project with a new sound born in a world of uncertainty. NEW ALBUM to be released in early 2021. Catch ’em live. Tour dates TBA soon!

The New Single "Can You Feel It" is Out...

The New Single

“Can You Feel It”

is Out…

GET IT BACK VIDEO

Play Video

CAN YOU FEEL IT VIDEO

Play Video

THE LYRIC VIDEO

Play Video

Play Video

MANY MILES AWAY "IKYK" LIVE @ The Royal SLC 4/24/21

PRESS ARTICLES

PRESS INQUIRIES:

Eileen Shapiro

631-506-6600

rockstarjournalist33@gmail.com

World Star PR

jimmystarsworld.com/world-star-pr

BOOKING INQUIRIES:

Brian Towers

925-351-7869

brian@bt-artists.com

bt-artists.com/

CONTACT US

Thanks for visiting